The 11th hour funding stimulus and spending package from Congress includes some bright spots for clean energy and climate action as we round out an otherwise dark year.

It couldn’t come soon enough. American workers and companies are struggling — including those in the business of making our homes, buildings and electricity supplies cleaner. Since the start of the COVID-19 pandemic, nearly a half-million clean energy workers have lost their jobs, according to E2’s latest research. And with the industry headed into what is traditionally the slowest time of the year, this winter is especially bleak.

Some highlights from the omnibus stimulus and spending package:

· ENERGY EFFICIENCY: The package includes $82 billion in funding for colleges and other schools including to improve energy efficiency and upgrade HVAC systems at schools shut down during the pandemic. Congress also agreed to increase funding for the Department of Energy’s Weatherization Assistance program and extend tax deductions for energy efficiency in commercial buildings. Hopefully, this will help get some of the get some of America’s 314,000+ unemployed energy efficiency workers back on the job while also saving money for consumers, businesses and local governments with every monthly electric bill. They’ll also make our schools safer when students are able to fully return to the classroom.

· RENEWABLE ENERGY: The Production Tax Credit (PTC) for wind will be extended through 2021 while the Investment Tax Credit (ITC) for Solar will extend through 2023. Non-business solar tax credits for individuals also are extended through 2023.

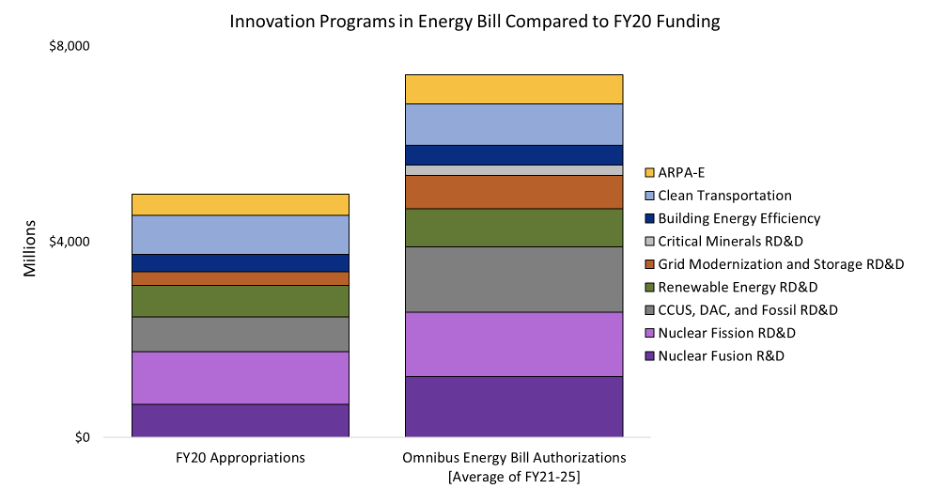

· CLEAN ENERGY RD&D: The package expands important federal clean energy research, development, and demonstration programs — including DOE’s Loan Guarantee Program and Advanced Research Projects Agency (ARPA-E). Of particular significance are funding increases for energy storage (batteries) and grid modernization. These investments are critical to the future of clean energy in America. In addition to funding this year, the package raised the level of funding that could be available next year. This great chart by NRDC’s Arjun Krishnaswami shows some of the increases for RD&D:

One of the most important policies contained in the omnibus spending bill has nothing to do with clean energy, but everything to do with helping our environment and economy.

Included in the omnibus package is the American Innovation and Manufacturing (AIM) Act, which sets standards to phase-down super pollutants known as HFCs, or hydrofluorocarbons, used in air conditioners, refrigerators and other applications. Under the AIM Act, America will cut the use of HFCs by 85 percent over the next 15 years. That will reduce heat-trapping carbon dioxide emissions by 150 million tons — or the equivalent of taking 32 million cars off the road.

The AIM Act is probably the most significant climate legislation passed by Congress this year, and one that illustrates how we can do good for our environment and our economy at the same time. In addition to cutting greenhouse gasses, it is expected to create 33,000 jobs and spur $12.5 billion of new investments as building owners, HVAC and appliance companies and others roll out new products to meet the legislation.

E2 and its members worked hard to push Congress to pass the clean energy extensions and expansions, as well as the AIM Act. For instance, we organized this letter to Congress from more than 200 architects, engineers and building efficiency professionals from every part of the country imploring lawmakers to pass the AIM Act. On clean energy, we also made sure lawmakers saw our extensive reports on clean energy jobs and our policy proposals and heard from our members in scores of virtual meetings we organized earlier this year.

While the last-minute stimulus and spending bill contained some significant provisions, it left out others that could have made it a lot better. It didn’t contain needed clean vehicles and infrastructure, or tax credits for batteries or storage. It did not include “direct pay” which is essential to ensuring clean energy companies can use the tax credits that were extended during the COVID downturn. Nor did it do anything to address the inequity in the availability of clean energy or the lack of diversity in clean energy jobs.

As Oregon Sen. Ron Wyden told E&E News, the package is a good start, but more needs to be done beginning in January with a new Congress and the Biden administration.

“I hope these extensions serve as a bridge to the comprehensive reform desperately needed to end our dependence on Big Oil and ensure that green jobs are good jobs,” Wyden said in a statement. “I plan to keep at it until America kicks its carbon habit once and for all.”

At E2, we plan to keep at it too.

Some Bright Spots for Clean Energy in Congressional Funding Package was originally published in e2org on Medium.